Vehicle Bonus Depreciation 2024

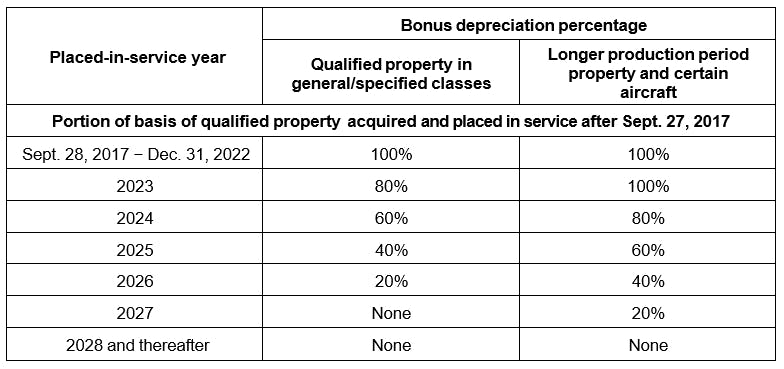

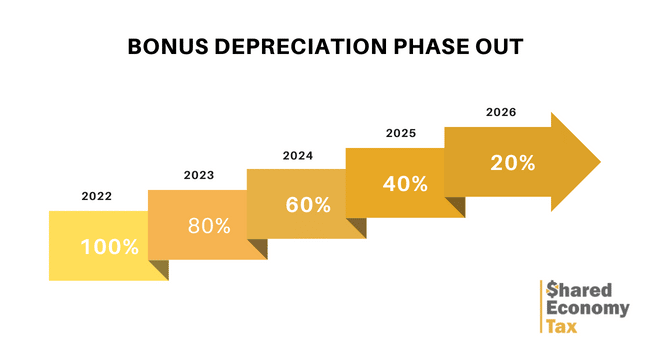

Vehicle Bonus Depreciation 2024 – If bonus depreciation does not apply, the 2024 first-year limitation is $12,400 ($200 higher than 2023), and the succeeding years’ limitations are the same as for vehicles eligible for the bonus . Add on “bonus depreciation” for business owners — a similar but bills by tens of thousands of dollars in a single year rather than depreciating their vehicle more slowly over time. Even these .

Vehicle Bonus Depreciation 2024

Source : m.facebook.comBonus depreciation rules, recovery periods for real property and

Source : www.bakertilly.comSection 179 Deduction – Section179.Org

Source : www.section179.orgNew | Family Powersports

Source : www.familypowersports.comA Guide to the Bonus Depreciation Phase Out 2023 Shared Economy Tax

Source : sharedeconomycpa.comWhat Is Bonus Depreciation? Definition and How It Works

Source : www.investopedia.comSection 179 Creates Year End Tax Advantages on Business Equipment

Source : www.loffler.comNew Inventory | Family Powersports Odessa | Odessa, TX 79762

Source : www.fpsodessa.comUnderstanding Tax Depreciation Rules for 2023 and 2024: Bonus

Source : hoodcpas.comTax Penalties, Section 179 and Bonus Depreciation Changes for the

Source : www.dtnpf.comVehicle Bonus Depreciation 2024 Amur Amur added a new photo.: However, bonus depreciation is calculated on a phase-down Qualifying property generally includes depreciable tangible personal property (e.g., machinery, vehicles, furniture, or equipment), . Action News Jax’s Ben Becker is investigating how a tax provision that was part of President Donald Trump’s Tax Cuts and Jobs Act of 2017 has led to new car washes and gas stations popping up in .

]]>

:max_bytes(150000):strip_icc()/Bonusdepreciation_final-8007f0af3e6e4913bc582bb9975f5384.png)